About This Report

Company Profile

Oxford Properties Group connects people to exceptional places, and is the owner, developer and manager of some of the world’s best real estate assets. Established in 1960, it manages over C$58 billion of assets across the globe on behalf of its co-owners and investment partners. Oxford’s portfolio encompasses office, retail, industrial, hotels and multifamily residential and spans over 100 million square feet in global gateway cities across four continents. A highly disciplined and thematic investor, Oxford invests in properties, portfolios, development sites, debt, securities and platform opportunities across the risk-reward spectrum. With regional head offices in Toronto, New York, London, Luxembourg, Singapore and Sydney, its long-term approach to real estate investment aligns Oxford’s interests to its customers and the communities in which it operates. Oxford is the global real estate arm of OMERS, the AAA credit rated defined benefit pension plan for Ontario’s municipal employees.

General

Oxford’s annual Sustainability Report provides information related to the environmental, social and governance aspects of the organization and outlines how the organization engages with its customers. The period covered by this report is January 1, 2015 to December 31, 2018. The report provides an overview of our framework, priorities and select initiatives. This report is generally aligned with the GRI Standards.

Boundaries

Organizational Boundaries

Oxford uses an Operational Control approach to set its Organizational Boundary.

Operational Control is defined as “the ability to introduce and implement operating policies, health and safety policies and/or environmental policies” (from GRESB).

Oxford is deemed to have the ability to introduce and implement these policies for buildings that Oxford directly manages OR where Oxford has a 25% or greater ownership interest in the building.

Oxford’s organizational boundary for Oxford’s annual Sustainability Report is defined as follows:

| INCLUDED1 | EXCLUDED2 |

|---|---|

|

|

Operational Boundaries

Environmental Performance Indicators

Environmental performance indicators are calculated for all assets (whole building) within Oxford’s boundary, on an annual basis.

Energy includes electricity, natural gas, steam, propane, deep lake chilled water and diesel. Energy intensity is the key performance metric reported by Oxford.

Greenhouse gas emissions refer to human activities, such as the burning of fossil fuels, which release greenhouse gases to the atmosphere. GHG Emission intensity is the key performance metric reported by Oxford.

Oxford reports on the following greenhouse gases, consistent with the GHG Protocol:

| Direct (SCOPE 1) | Indirect (SCOPE 2) |

|---|---|

|

|

Oxford updates emission factors on an annual basis, from generally recognized sources, as new factors become available.

Water includes the total volume of water withdrawn from municipal supplies, groundwater, or rainwater collected and stored by the organization. Water intensity is the key performance metric reported by Oxford.

Waste denotes materials generated on site for disposal, both hazardous and non-hazardous, excluding wastewater.

Waste diversion is the process of diverting waste from landfills and incineration through waste re-use, recycling (including composting), or through waste-to-energy. Assets in less mature recycling markets contributed to a decreased diversion rate in our managed portfolio. Waste diversion (expressed as a %) is the key performance metric reported by Oxford.

Non-Environmental Performance Indicators

Reporting around Oxford employees includes full-time, part-time, contract and unionized employees across Oxford’s global platform (unless otherwise noted).

Performance data for health & safety metrics are applicable to employees across Canada only at this time.

Data

Data presented in the report is not normalized for vacancy, weather or other factors.

Performance data for newly acquired assets is included once an asset has been under Oxford's operational control for a full calendar year.

Performance data for newly developed assets is included once an asset has a full calendar year of data.

Performance data for disposed assets ceases after the last full calendar year of data under Oxford’s ownership.

Material Aspects

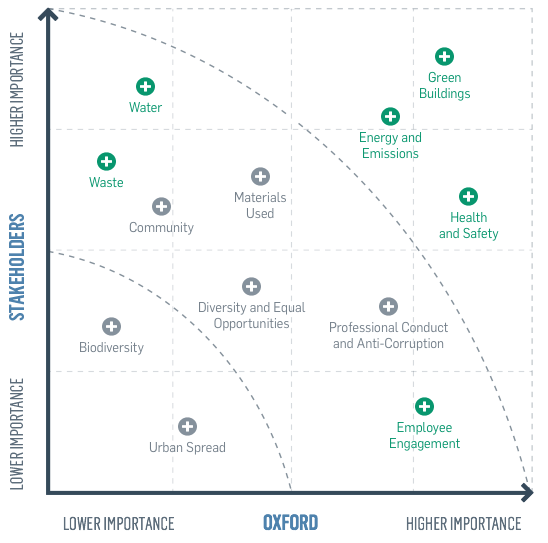

We focus on the sustainability issues that matter most to our customers, employees, shareholders and co-owners.

The materiality matrix below provides an overview of how we have assessed the relative importance of sustainability issues in collaboration with our customers. The matrix is used to guide our target setting and reporting and to drive results in the areas where we can have the greatest impact.

Move your mouse or tap, if using a touch-screen device, over the hot-spots for more information.

Energy

Buildings

and Wellbeing

Engagement

Opportunities

and Anti-Corruption

Oxford periodically reviews and documents changes to the materiality matrix based on a range of factors including: customer surveys, customer green team meeting feedback, Oxford management feedback during Steering Committee or other strategy meetings, supplier meeting feedback, best practice research, and competitive analysis.

Additional Information

This report does not cover all ESG issues that Oxford is actively managing.

Information profiled in the report rotates periodically, and additional information is available upon request.

Changes from Previous Year’s Reporting

Oxford changed its approach to reporting square footage in 2019.

All intensity metrics now reference Gross Floor Area (instead of Gross Leasable Area).

This is applicable for all asset classes and regions.

Contact

The contact point for questions regarding this report or its contents is:

Darryl Neate, Director, Sustainability, at sustainableintelligence@oxfordproperties.com

1 Included assets are those we have operational control and have access to bills.

2 Excluded assets are where Oxford does not have operational control or does not have access to utility bills.

3 Includes fully open air shopping centres (e.g. Dix 30) and pads on enclosed shopping centres (e.g. Scarborough Town Centre, Square One); non-strategic retail is classified as a short-term hold.